|

Balanced Trade Operations

|

|

|

CBP has emphasized the proactive and strict enforcement of U.S. trade laws to protect national economic security, facilitate fair trade, support the health and safety of the American people, and ensure a level playing field for U.S. industry.

- TFTEA Overview - Read more about the legislation, including key changes, authorities, and initiatives.

- CBP Trade Enforcement Operational Approach - Learn more about CBP's trade enforcement operational approach detailing how the organization DETECTS, DETERS, and DISRUPTS fraudulent behavior as a means of protecting America's economic security

- CBP Trade Enforcement Bulletin - The Quarterly CBP Trade Enforcement Bulletin highlights specific instances in which CBP enforces U.S. trade laws at and beyond our nation's borders through interagency partnership and collaboration

|

|

|

|

Automated Commercial Environment (ACE)

|

|

|

TFTEA extends funding for ACE, the system by which the U.S. has implemented the Single Window. ACE connects CBP, the international trade community, and more than 47 Partner Government Agencies (PGAs). ACE facilitates legitimate trade while strengthening border security by providing government officials with better automated tools and information.

- Across government and industry, automated capabilities, agreements, and business and technical requirements are in place to transmit and process import and export data electronically in ACE.

- ACE Features and Benefits - Overview of how manual processes are streamlined and automated; paper has been eliminated and the trade community can more easily and efficiently comply with U.S. laws and regulations.

|

|

|

Antidumping and Countervailing Duties (AD/CVD)

|

|

|

|

TFTEA established a new administrative procedure for investigating allegations of evasion of AD/CVD orders (i.e., including ability to draw adverse inferences for failing to provide information). CBP enforces AD/CVD orders as part of the agency's efforts to ensure a level playing field for U.S. industry.

|

|

|

Enforce and Protect Act of 2015 (EAPA)

|

|

|

Title IV, Section 421 of TFTEA is commonly known as the Enforce and Protect Act of 2015 (EAPA). EAPA establishes formal procedures for submitting, and investigating antidumping or countervailing allegations of evasion against U.S. importers.

|

|

|

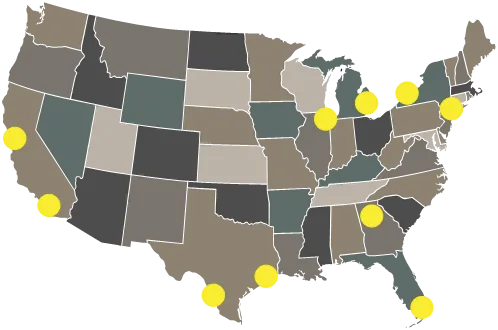

Centers of Excellence and Expertise (Centers)

|

|

|

CBP created 10 industry-specific Centers to increase uniformity at the ports, facilitate the timely resolution of trade compliance issues nationwide, and further strengthen the agency's knowledge about industry practices.

- Centers Webpage - Information on how the Centers transform the way CBP approaches trade operations and works with the international trade community; the Centers are aligning with modern business practices, focusing on industry-specific issues, and providing tailored support to unique trading environments

- Federal Register - Regulatory authorities and codification of centers under TFTEA

- Centers Directory - A directory that provides all contact information for each of the Centers

|

|

|

De Minimis Value Exemption

|

|

|

As a result of TFTEA provisions, CBP raised the De Minimis value, i.e., value of a shipment of merchandise imported by one person in one day that generally may be imported free of duties and taxes, from $200 to $800 per shipment.

- Section 321 Program -Section 321, 19 USC 1321 is the statute that describes de minimis. De minimis provides admission of articles free of duty and of any tax imposed on or by reason of importation, but the aggregate fair retail value in the country of shipment of articles imported by one person on one day and exempted from the payment of duty shall not exceed $800.

|

|

|

Forced Labor

|

|

|

TFTEA prohibits all products made by forced labor, including child labor, from being imported into the United States.

- Forced Labor Webpage - Information on the United States' stance on the importation of goods produced by forced or indentured child labor, guidance on how the public can report suspected violations, and additional forced labor information

|

|

|

Intellectual Property Rights (IPR)

|

|

|

CBP has provided new tools to better enforce IPR, enhance collaboration with IPR holders, and strengthen international partnerships to stop counterfeiting at the source.

|

|

| |

Drawback

|

|

|

TFTEA included a sweeping “game-changer,” for the CBP drawback program, providing numerous and significant enhancements to the drawback laws under 19 U.S.C. § 1313, long-sought over the past decade by both CBP and the trade.

|

|